Whereas the guards or the janitors who are employed to supervise and assist during the production process are indirect laborers and are not included as a part of direct labor. While the job is being performed, you need to maintain a job cost sheet to track the actual material and labor being used. This sheet will help you evaluate if the actual cost of doing the job differs from your estimate.

Similarities between Process Costing and Job Order Costing

Factory overheads are all added together is included in the cost sheet at the end and is charged to the finished items. While still in production, the work in process units are moved from one department to the next until they are completed, so the work in process inventory includes all of the units in the shaping and packaging departments. When the units are completed, they are transferred to finished goods inventory and become costs of goods sold when the product is sold. Since there are eight slices per pizza, the leftover pizza would be considered two full equivalent units of pizzas.

Factory overhead

Each department, or process, will have its own work in process inventory account, but there will only be one finished goods inventory account. The costing system used typically depends on whether the company can most efficiently and economically trace the costs to the job (favoring job order costing system) or to the production department or batch (favoring a process costing system). The incurred indirect costs should be allocated to the job based on previous examples.

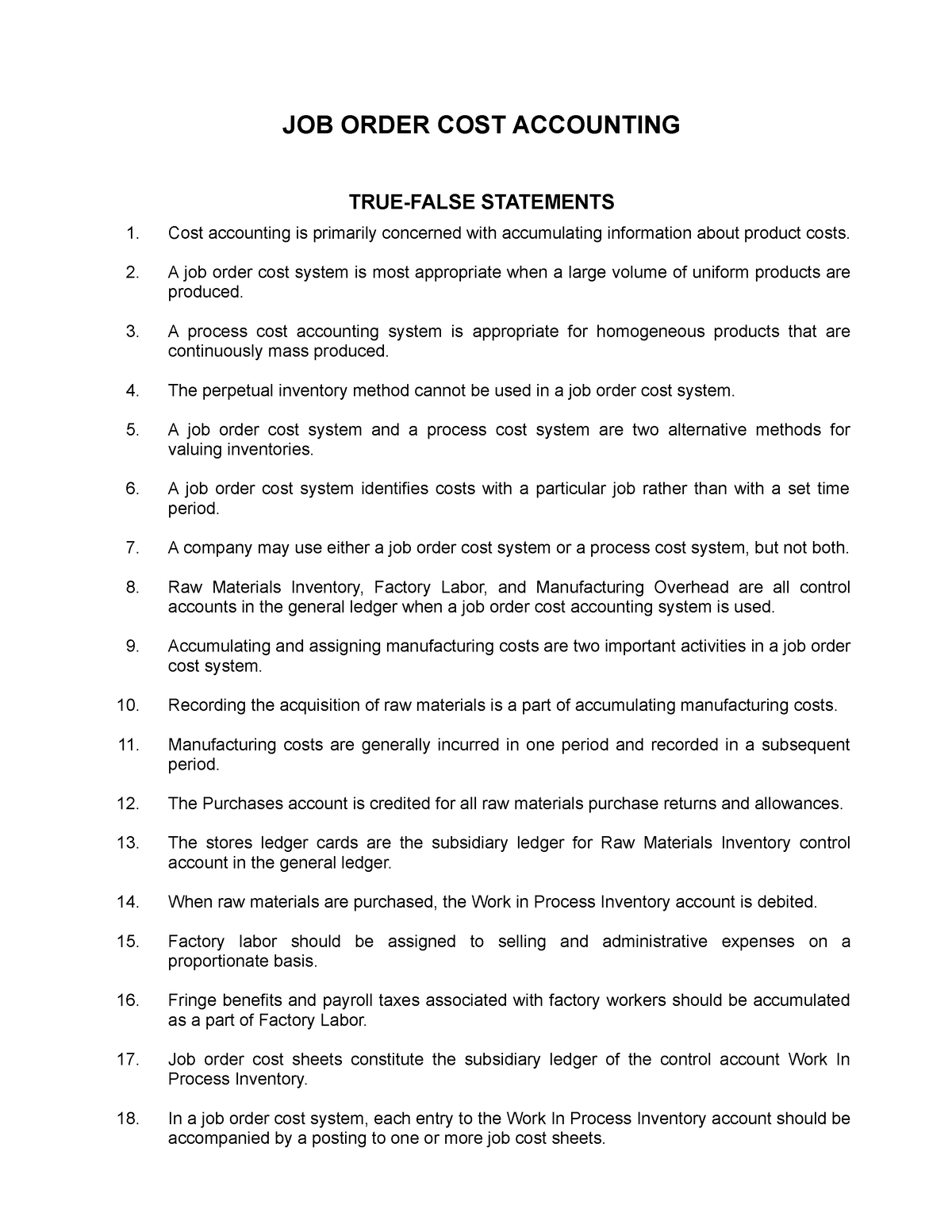

1: Compare and Contrast Job Order Costing and Process Costing

Under generally accepted accounting principles (GAAP), separating the production costs and assigning them to the department results in the costs of the product staying with the work in process inventory for each department. This follows the expense recognition principle because the cost of the product is expensed when revenue from the sale is recognized. Once the job is completed, you need to revise the actual cost by adding the additional costs which might be incurred while doing the job with respect to the estimate given to the customer.

While making drumsticks may sound simple, an immense amount of technology is involved. It is difficult to tell the first drumstick made on Monday from the \(32,000\)th one made on Thursday, so a computer matches the sticks in pairs based on the tone produced. Texas Monthly reports that Sandy found a way to write unapproved checks in the accounting system.

Calculating the costs

- Manufacturing departments are often organized by the various stages of the production process.

- Even two sticks made sequentially may have different weights because the wood varies in density.

- However, if each fastener had to be requisitioned and each ounce of glue recorded, the product would take longer to make and the direct labor cost would be higher.

While the costing systems are different from each other, management uses the information provided to make similar managerial decisions, such as setting the sales price. For example, in a job order cost system, each job is unique, which allows management to establish individual prices for individual projects. The difference between process costing and job order costing relates to how the costs are assigned to the products. This results in the costing system selected being the one that best matches the manufacturing process. Once the direct and indirect costs are calculated, they’re added together and submitted to the client to give a quote for the job.

Efficient job order costing helps companies to create quotes that are low enough to be competitive but still profitable for the company. Many direct material costs, as the wood in the frame, are easy to identify as direct costs because the material is identifiable in the final product. Process costing and job order costing are both acceptable methods for tracking costs and production levels.

Rock City Percussion uses a process cost system because the drumsticks are produced in batches, and it is not economically feasible to trace the direct labor or direct material, like hickory, to a specific drumstick. Therefore, the costs are maintained by each department, sales credit journal entry how to record credit sales rather than by job, as they are in job order costing. Companies that mass produce a product allocate the costs to each department and use process costing. For example, General Mills uses process costing for its cereal, pasta, baking products, and pet foods.