In contrast, video game companies, fashion designers, or trading firms may have little or no book value because they are only as good as the people who work there. Book value is not very useful in the latter case, but for companies with solid assets, it’s often the No.1 figure for investors. Book value is the amount found by totaling a company’s tangible assets (such as stocks, bonds, inventory, manufacturing equipment, real estate, and so forth) and subtracting its liabilities.

How to Calculate BVPS?

As long as the accountants have done a good job (and the company’s executives aren’t crooked) we can use the common equity measure for our analytical purposes. A common way of increasing BVPS is for companies to buy back common stocks from shareholders. This reduces the stock’s outstanding shares and decreases the amount by which the total stockholders’ equity is divided.

What is a good PB ratio to buy?

Now, let’s say that you’re considering investing in either Company A or Company B. Given that Company B has a higher book value per share, you might find it tempting to invest in that company. However, you would need to do some more research before making a final decision. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

How to Interpret BVPS?

This formula shows the net asset value available to common shareholders, excluding any preferred equity. A company’s stock is considered undervalued when BVPS is higher than a company’s market value or current stock price. If the BVPS increases, the stock is perceived as more valuable, and the price should increase. If the book value is based largely on equipment, rather than something that doesn’t rapidly depreciate (oil, land, etc.), it’s vital that you look beyond the ratio and into the components. Companies with lots of machinery, like railroads, or lots of financial instruments, like banks, tend to have large book values.

Is BVPS relevant for all types of companies?

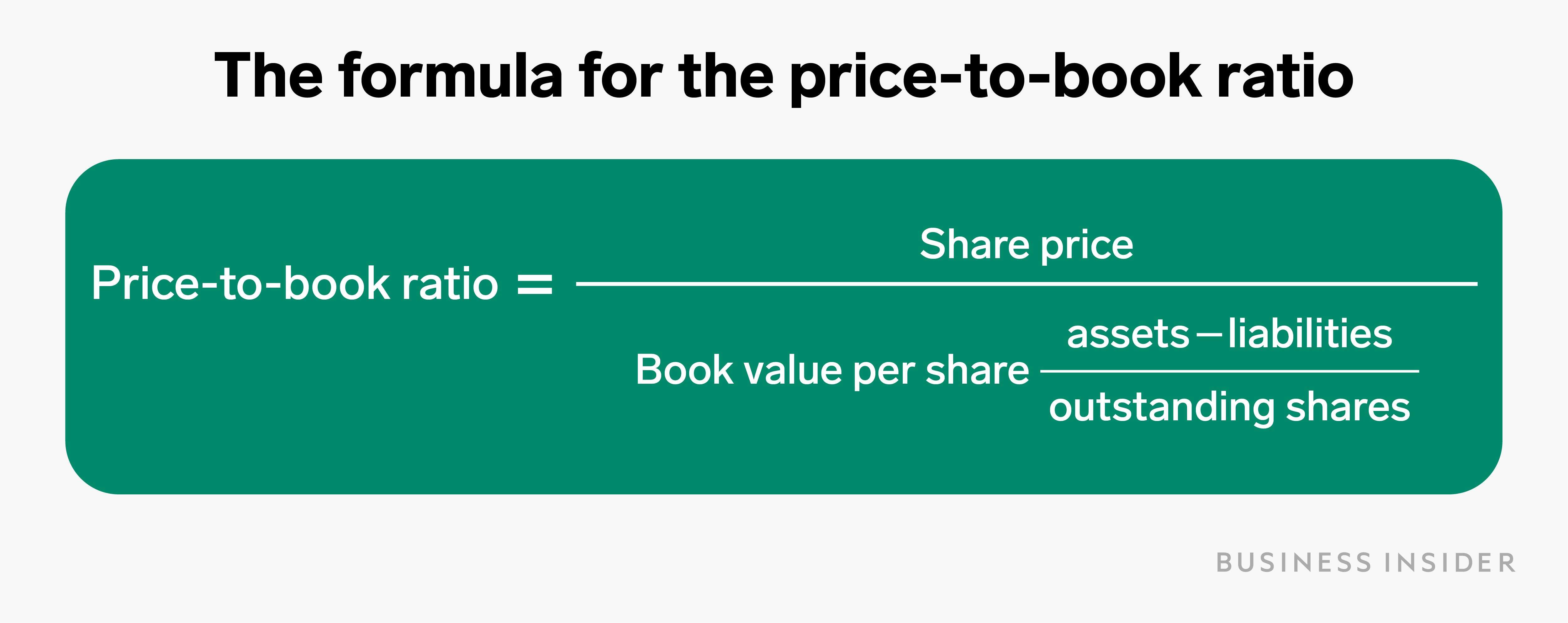

In some cases, a company will use excess earnings to update equipment rather than pay out dividends or expand operations. While this dip in earnings may drop the value of the company in the short term, it creates long-term book value because the company’s equipment is worth more and the costs have already been discounted. Manufacturing companies offer a good example of how depreciation can affect book value. These companies have to pay huge amounts of money for their equipment, but the resale value for equipment usually goes down faster than a company is required to depreciate it under accounting rules. A price-to-book ratio under 1.0 typically indicates an undervalued stock, although some value investors may set different thresholds such as less than 3.0. If the book value of a company is higher than its market value, it indicates that the stock market is less confident in the organisation’s earning capability, albeit its book value might.

How does BVPS differ from market value per share?

- Many share market apps offer various tools for stock market investment nowadays which may help you find out what is good PB ratio for a company..

- If a P/B ratio is less than one, the shares are selling for less than the value of the company’s assets.

- In this case, the company’s price/BVPS multiple seems to have been sliding for several years.

- This means that the BVPS is ($10 million / 1 million shares), or $10 per share.

- Outdated equipment may still add to book value, whereas appreciation in property may not be included.

Companies or industries that extensively rely on their human capital will have an inappropriate reflection of their worth in their financial statements. Booking value, more commonly known as book value, is an organisation’s worth according to its Balance Sheet. In another sense, it can also refer to the book value of an asset that is reached after deducting the accumulated depreciation from its original value. crossword clue: single entry in a list crossword solver Knowing what book value per share is, how to calculate it, and how it differs from other calculations, can add yet another tool to an investor’s tool chest. Alternatively, another method to increase the BVPS is via share repurchases (i.e. buybacks) from existing shareholders. For example, if a company has a total asset balance of $40mm and liabilities of $25mm, then the book value of equity (BVE) is $15mm.

In this case, the shares outstanding number is stated at 3.36 billion, so our BVPS number is $71.3 billion divided by 3.36 billion, which equals $21.22. Each share of common stock has a book value—or residual claim value—of $21.22. At the time Walmart’s 10-K for 2012 came out, the stock was trading in the $61 range, so the P/BVPS multiple at that time was around 2.9 times. The book value of a company is based on the amount of money that shareholders would get if liabilities were paid off and assets were liquidated.

The book value per share is just one metric that you should look at when considering an investment. It’s important to remember that the book value per share is not the only metric that you should consider when making an investment decision. For asset-heavy industries, BVPS might provide a reasonable estimate of value. However, for sectors like technology and pharmaceuticals, where intellectual property and ongoing research and development are crucial, BVPS can be misleading. Investors use BVPS to gauge whether a stock is trading below or above its intrinsic value. Hampshire Police opened an investigation into Smyth in 2017 after his abuse had been the subject of a Channel 4 News report.